nh bonus tax calculator

Your average tax rate is 222 and your marginal tax rate is 361This marginal tax rate means that your immediate additional income will be taxed at this rate. New Hampshire Tax Deductions Income tax deductions are expenses that can be deducted from your gross pre-tax income.

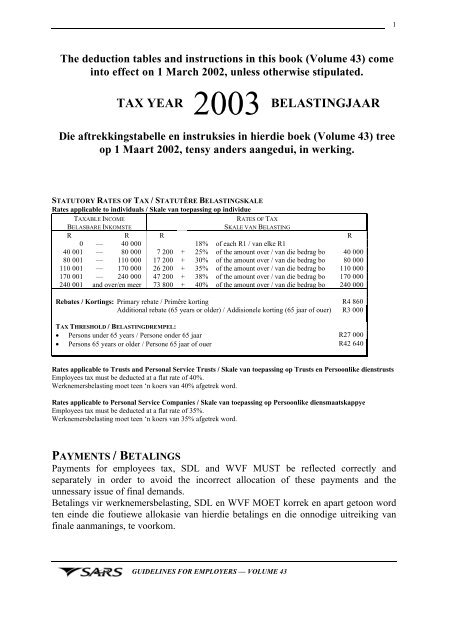

Sars Employee Tax Deductions Guidelines Workinfo Com

For multi-state businesses income is apportioned using a weighted sales factor of two and the payroll and property factors.

. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. While its not a fun number to calculate your portion of the transfer tax will be. Using deductions is an excellent way to reduce your New Hampshire income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and New Hampshire tax returns.

New Hampshire Aggregate Bonus payroll pay NH aggregate bonus payroll calculator pay check payroll tax calculator tax calculators tax calculator take home pay calculator retirement wage calculator payroll services calculator. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. New Hampshire Sales Tax Calculator.

What is the Business Profits Tax BPT. Use this calculator to help determine. People with more complex tax situations should use the instructions in Publication 505 Tax Withholding and Estimated Tax.

If your state doesnt have a special supplemental rate see our aggregate bonus calculator. Calculate withholding on special wage payments such as bonuses. And remember to pay your state unemployment.

Below are your New Hampshire salary paycheck results. State of New Hampshire. A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Social Security is taxed at 62 and Medicare at 145. This tax is not paid directly by the consumer.

Supports hourly salary income and multiple pay frequencies. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Hampshire local counties cities and special taxation districts. 4500 2 2250.

Taxes not paid state-wide and for a lump sum your bonus is considered supplemental income and will be taxable at a 22 flat rate by the IRS. In NH transfer tax is split in half by buyer and seller. Use this calculator to help determine.

Call the Departments Tobacco Tax Group at 603 230-4359 or write to the NH DRA Tobacco Tax Group PO Box 1388 Concord NH 03302-1388. How Do I Calculate Tax On My Bonus. Divide the total transfer tax by two.

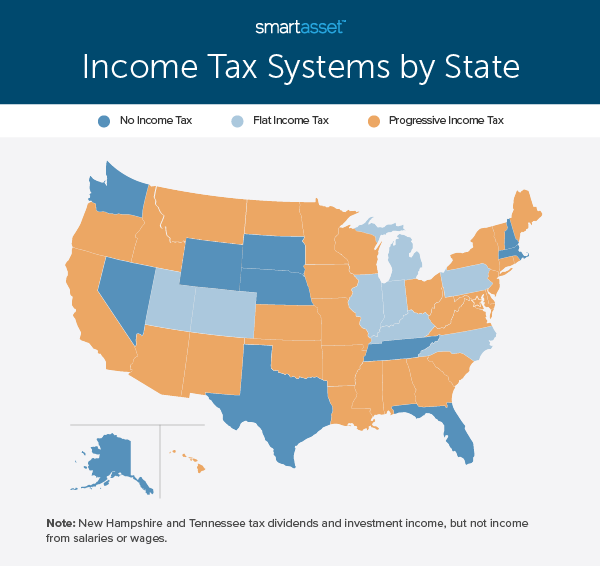

New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122. If calling to inquire about the purchase of Tobacco Tax Stamps please contact the Collections Division at 603 230-5900. Tennessee and New Hampshire fall into a gray area.

This Tax Withholding Estimator works for most taxpayers. We hope you found the United States Annual Tax Calculator for 2022 useful we have collated the following US Tax guides to support the US Tax Calculators and US Salary Calculators published on iCalculator. Take the purchase price of the property and multiply by 15.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. This free easy to use payroll calculator will calculate your take home pay.

New Hampshire Bonus Tax Percent Calculator Results. Each tax guide is designed to support you use of the US tax calculators and with calculating and completing. They may not.

The gas tax in New Hampshire is equal to 2220 cents per gallon. Heres how to find that number. New Hampshire has a 0 statewide sales tax rate.

New Hampshire Cigarette Tax. One thing youll notice on your New Hampshire paycheck is deductions for FICA Federal Insurance Contributions Act taxes. New Hampshire Gas Tax.

While they dont impose a tax on income there is a state tax on interest and dividends. This includes taxpayers who owe alternative minimum tax or certain other taxes and people with long-term capital gains or qualified dividends. For taxable periods ending before December 31 2016 an 85 tax is assessed on income from conducting business activity within the State of New Hampshire.

If your company receives a 6000 bonus you have likely withheld enough into federal taxes 6000 x 2 times 12. FICA taxes are Social Security and Medicare taxes and they are withheld from each of your paychecks in order for you to pay into these systems. This is the 24th-highest cigarette tax in the US.

New Hampshires excise tax on cigarettes totals 178 per pack of 20. Calculates Federal FICA Medicare and withholding taxes for all 50 states. NHgov privacy policy accessibility policy.

New employers should use 27. You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code. The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter.

A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out. They should not be relied upon to calculate exact taxes payroll or other financial data. If you make 55000 a year living in the region of New York USA you will be taxed 12213That means that your net pay will be 42787 per year or 3566 per month.

That tax applies to both regular and diesel fuel. The results are broken up into three sections. 300000 x 015 4500 transfer tax total.

As an aside unlike the federal government states often tax municipal bond interest from securities issued outside a certain state and many allow a full or partial exemption for pension income.

What Is The Average Bonus Percentage 2022 29 Facts And Statistics About Bonuses Zippia

Bonus Tax Rates Aggregate Bonus Pay Calculator Onpay

Llc Tax Calculator Definitive Small Business Tax Estimator

Understanding Payroll Taxes And Who Pays Them Smartasset

How To Do Payroll In Excel In 7 Steps Free Template

Free Paycheck Calculator Hourly Salary Usa Dremployee

How To Do Payroll In Excel In 7 Steps Free Template

Bonus Calculator Percentage Method Primepay

Llc Tax Calculator Definitive Small Business Tax Estimator

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Tax Calculator Price Before Tax After Tax More

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Llc Tax Calculator Definitive Small Business Tax Estimator

Marriage Tax Penalties And Bonuses In America 2020 Study